The 2017 SMSF return: are you up for the challenge?

This article is reprinted from Acuity Magazine.

Under the new super rules, this year’s SMSF returns are going to be very complex and it’s important that practitioners are up to speed.

In Brief

- There’s no such thing as simple super anymore.

- The changes are the most significant in a decade and all details must be considered.

- There are now three options to be looked at.

Changes to Capital Gains Tax (CGT) rules require practitioners to carefully explore the full range of options, says Tony Negline, Superannuation Leader, Chartered Accountants ANZ.

Trustees of SMSFs eligible for CGT relief need to know there are other options besides simply uplifting the cost base of growth assets and deferring capital gains, says Negline.

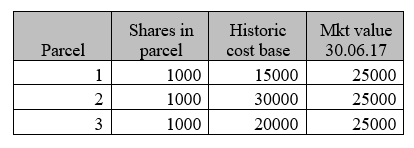

Consider an SMSF eligible for CGT relief with one member who has over $1.6m in pension phase and another member in accumulation phase. The fund was unsegregated – that is, using the proportional method – for tax for the 2017 tax year and holds three parcels of shares in a Big Four bank.

Once the fund calculates the asset gain or loss position at 30 June 2017, there are three options:

- Electing no CGT relief

- Electing relief, but no deferral of capital gains and capital losses

- Electing relief, but deferral of capital gains only (Source: ATO Law Companion Guideline 2016/8)

Under Option One, the fund trustees may elect no relief for any CGT assets, as it may be difficult to justify the cost of CGT relief analysis and deliver certain value to clients.

If Option Three is chosen for assets with unrealised capital gains, the fund commits to book a deferred tax liability and defer the capital gains until the asset is sold. However, “This may not be desirable, if the accumulation member will soon move to pension phase,” says Negline.

For assets with unrealised capital losses at 30 June 2017, trustees may choose Option Two and match these against actual or deemed capital gains which arise from choosing CGT relief which practically means going forward with a cost base lower than the actual buying price for some assets.

In addition, if the fund sells 1,000 bank shares during 2017/18 (say for $2.50 per share), the trustees can decide which of the three parcels is sold. If the sales occur before lodging the 2016/17 return, this may have a big impact on CGT relief planning.

For example, if the sale is deemed to be parcel 2 shares, and Option one (no relief) is chosen for these shares, a gross capital loss in the 2017/18 year of $5,000 will arise. The trustee would still need to decide what to do with parcels one and three.

Some of the risks in the above scenario for SMSF practitioners include:

- Not knowing all these options are available

- Accepting CGT relief options that software seems to pre-empt

- Spending too much time on this type of analysis and finding little or negligible benefit for the client

People’s knowledge of the biggest changes to super in a decade will be tested over the next year and it is important to take into account all the detail so that clients can be assisted.